colorado estate tax exemption 2021

The three basic requirements are. Property Taxation - Declaration Schedules.

Kylie Hamessley Realtor On Instagram Another Client Under Contract Thanks To My Favorite Colorado Real Colorado Real Estate Real Estate Agent Estate Agent

The number of veterans claiming the exemption has also grown over.

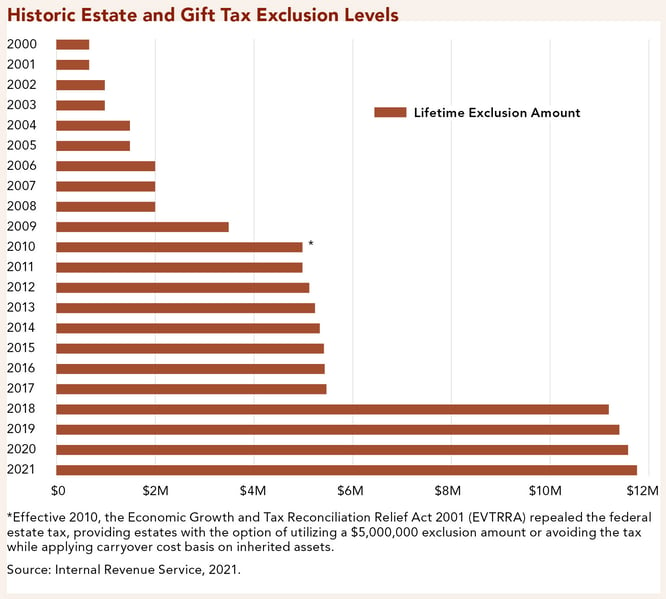

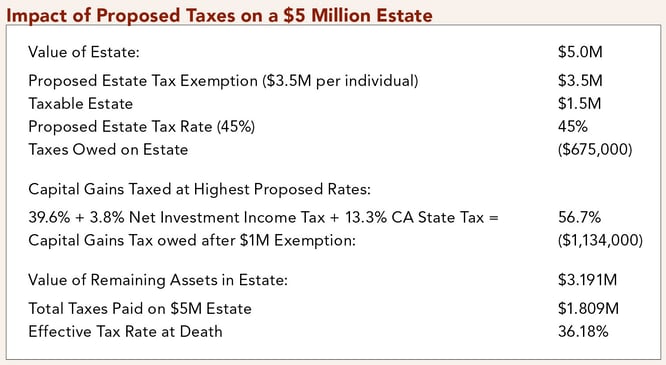

. Those who miss the deadline and forfeit tax exemption will receive notifications by mail. However the federal unified credit reduces the federal estate tax liability and therefore can affect the state tax liability. The exemption for that tax is 1170 million for deaths in 2021 and 1206 million in 2022.

The taxes owed for apartment properties would be reduced by about 5 percent. Even though there is no estate tax in Colorado you may still owe the federal estate tax. A non-probate asset is property of an estate that is not required to pass through the probate process or any similar to it.

From Fisher Investments 40 years managing money and helping thousands of families. If the Colorado Department of Revenue determines that an organization qualifies the organization will receive a Certificate of Exemption that authorizes it to purchase items and services without paying state sales tax and state-administered local sales taxes when these items and services are used to conduct the organizations regular charitable function. Colorado Property TaxRentHeat Rebate Application form only DR 0104PTC Libro Spanish.

Another law will temporarily lower property tax rates for tax years 2022 and 2023. This tax is portable for married couples. Also exemptions may be specific to a state county city or special district.

Colorado inheritance laws are designed to dig up a relative who could inherit your property. In FY 2020-21 reimbursements for the senior homestead exemption totaled 1531 million from the state General Fund. Application for Sales Tax Exemption for Colorado Organizations.

Fifty percent of the first 200000 in actual property value is exempt from property taxation. In November 2006 voters approved Referendum E which extended the property tax exemption to veterans with a service-related disability living in Colorado beginning in property tax year 2007. The unified credit applies to both federal gift tax and estate taxes.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Individual taxpayers may also receive a sales tax refund if they file a 2021 income tax return by October 18 2022. All taxpayers who file a 2021 income tax return will automatically receive the income tax rate reduction from 455 to 450.

Two measures House Bill 1311 and House Bill 1312 would roll back nearly 350 million in tax exemptions for Colorados wealthiest residents and businesses. Late reports filed after the April 15 deadline must be accompanied by the 250 late filing fee. The exemption is adjusted for inflation thereafter.

1 the qualifying senior must be at least 65 years old on January 1 of the year in which he or she qualifies. 1 2021 and Jan. Colorado Senior Property Tax Exemption A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified.

That recouped revenue would under House Bill 1311 go toward expanding tax programs benefiting low-income people and families such as the Earned Income Tax Credit and Child Tax Credit. For the six refund levels based on a taxpayers adjusted gross income see the 2021 form DR 0104. The 2022 filing period ends July 1 2022 for schools charitable organizations and fraternalveteran groups.

The Act increases the exemption for business personal property tax from 7700 to 50000 for tax years beginning Jan. Statement of Non-Profit Church Synagogue or Organization. Forms published in 2021 onward are fillable and savable except the instruction booklets.

Pursuant to 39-3-1195 the personal property minimum filing exemption threshold exemption amount for tax years 2021 and 2022 is 50000 or less in total actual value. Certain products and services are exempt form Colorado state sales tax. The deadline to file a 2022 Exempt Property Report is April 15 2022.

175 for Applications for Exemption 75 for timely filed Exempt Property Reports 250 for Exempt Property Reports filed after the initial April 15 deadline. Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone. That means that if the right legal steps are taken a married couple can protect up to 2412 million when both spouses die.

Seniors andor surviving spouses who qualify for the property tax exemption must submit an application to their county assessors between. The state is required to reimburse local governments for the lost revenue as a result of the increased exemption. The Colorado estate tax is calculated as the share of the estate that includes Colorado property multiplied by the state death tax credit.

No state exemptions are allowed. If an estate tax. Please submit completed declaration schedules to the Colorado county assessors office in which the property is located as of the January 1.

But should there be no one left to claim it it will escheat into the states hands. Carefully review the guidance publication linked to the exemption listed below to ensure that the exemption applies to your specific tax situation. Timely filings with a 75 filing fee per report are due by April 15.

Remedies for Recipients of Notice of Forfeiture of Right to Claim Exemption Instructions and FAQs Annual Reports for Exempt Property Schools Charitable 2022 FraternalVeterans Organizations 2022 Religious Purposes 2021 Religious Purposes 2022 Exempt Property Report Online Filing. Religious groups may continue to file late 2022 reports until July 1 2023. Single family homes would get a.

Restructuring At Stryker Will Mean Limited Reductions Of Workforce Ortho Spine News Summer Internship Internship Program Internship

Colorado Estate Tax Everything You Need To Know Smartasset

Wisconsin W4 Wisconsin State Annuity How To Find Out

How To Avoid Estate Taxes With A Trust

Colorado Estate Tax Everything You Need To Know Smartasset

Tax Saving Infographic 2015 16 Tax Saving Investment Savings Infographic Tax

How Current Us Tax Policy Impacts Donors And Nonprofits

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Colorado Estate Tax Everything You Need To Know Smartasset

Colorado Estate Tax Do I Need To Worry Brestel Bucar

What Is A Homestead Exemption And How Does It Work Lendingtree

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

A New Era In Death And Estate Taxes

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Colorado Estate Tax Do I Need To Worry Brestel Bucar

A New Era In Death And Estate Taxes

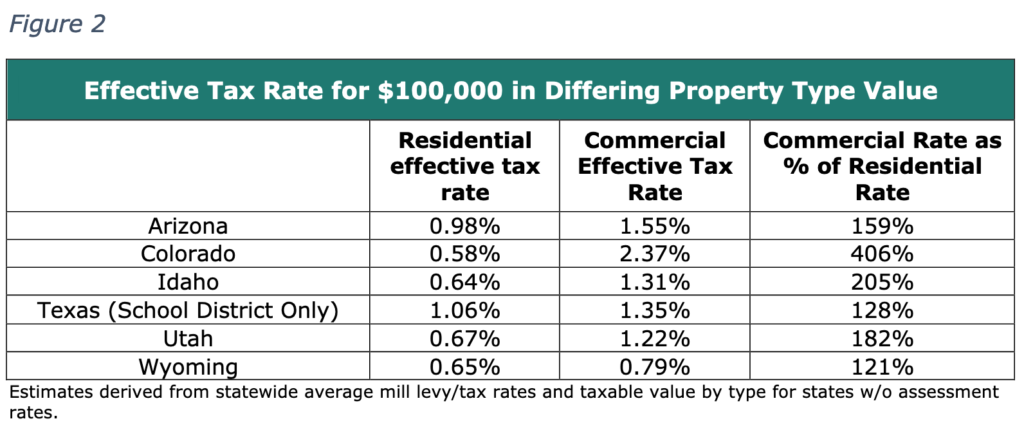

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

What You Need To Know About The 11 Million Estate Tax Exemption Going Away